Check out these articles about cooking and grocery shopping with food stamps:

Check out these articles about cooking and grocery shopping with food stamps:

It’s that time of year again…back to the books, all-nighters and classes. Here is some motivation to start off your senior year with a bang! Y’all got this.

http://vocaladymagazine.com/2015/07/27/4-ways-to-get-back-into-the-back-to-school-groove/

I used all four years of College to ignore my debt. It was a burden I wasn’t ready to carry and also at that point I wasn’t really convinced that I would dig myself into a financial hole. If I was already conscience about how I spent my money – why would I ever wind up $30,000 in debt? It didn’t make sense, but I knew that it went hand-in-hand with my financial aid packet. So, if I wanted to go to school and graduate – I would take the financial aid packet and work whenever I had free time.

Because I was avoiding by loans, I thought I had more money than I really did. I did not pay attention to how I was budgeting, if I had cut back on a few cups of coffee here and there – I could have freed up some extra cash. And that cash could have ensured, at the least, that my interest was not growing at rapid speeds. I was convinced that I was a victim of my loans. Anytime student loans were brought up, I would zip out of that room faster than you could say “principal balance”. I was in the same situation Ariel was when she had to give her voice to Ursela in order to have a pair of legs. I had to take on these loans to get a leg up in the job market. Then I started telling myself – if everyone else had debts, what did my debt really mean? It wasn’t like I was the only one getting a ‘F’ in a class full of ‘A’s’ – I was getting a ‘F’ along side all the other ‘F’s’. So really ground zero wasn’t being free of debt – it was -$30,000.

Then I graduated, and along side the quarter life crisis, I was realizing that I needed to do something about those loans. That first month out of College, oh boy, I kept finding myself contemplating about life, death and nihilism. I wasn’t getting any answers, but the pressure was still there. This was the turning point – the very first step: Acknowledging that I had loans, and I could do something about it. Continue reading

Here’s a great article from Jezebel on How to Navigate a New Job

One of the great tips is “Figure out your workplace culture.” Workplace dynamics are definitely important to learn how to navigate.

Another great article comes from US News on How to Adjust to a New Job

Remember, adjustments do take time!

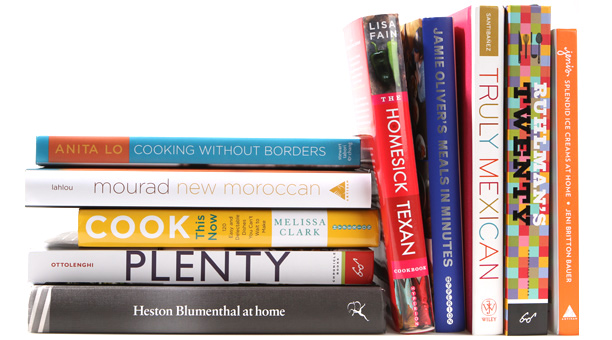

This is an article from the Simple Dollar called Teaching Yourself to Cook at Home: Ten Tips from My Kitchen to Yours

It has some great tips like “Measuring your ingredients beforehand,” which is something that I’m going to try.

Check out this great article on Saving Money on Groceries!

One of the tips is using a Price Book, which I have found extremely helpful myself. It helps me keep track of my spending habits as well as the cost of items so that I can buy the cheapest and best product.

They even have tips and tricks!

Check them out here:

Goodbye College, Hello Future: Why Retirement Savings Matters in Your 20s

Tips & Tweets: Get the #Money411 from the Experts

Also check out You Need a Budget, which is a software free for students!

More of a visual person? Check out this visual representation of the above article: