Thank you to Kirsten Adams ’16 for letting us reblog her post. Check out her BMC Banter Blog!

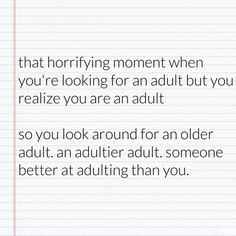

At the beginning of last semester, this meme was floating around the internet. It perfectly captured how I was feeling about recently turning 21 and preparing to enter the “real” world. During my internship last summer, one of my students came up to me and asked permission to do something. My first instinct was to tell them to ask “an adult” until I realized that I *was* the adult in the room, and I had the authority to give them an answer. The idea of becoming a better, “adultier adult” is especially relevant right now as I am starting to think about postgraduate life, expenses, and worries. Luckily for me, and every mawrter, Bryn Mawr has created programming geared towards helping students become prepared and confident adultier adults.

At the beginning of last semester, this meme was floating around the internet. It perfectly captured how I was feeling about recently turning 21 and preparing to enter the “real” world. During my internship last summer, one of my students came up to me and asked permission to do something. My first instinct was to tell them to ask “an adult” until I realized that I *was* the adult in the room, and I had the authority to give them an answer. The idea of becoming a better, “adultier adult” is especially relevant right now as I am starting to think about postgraduate life, expenses, and worries. Luckily for me, and every mawrter, Bryn Mawr has created programming geared towards helping students become prepared and confident adultier adults.

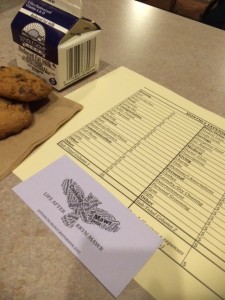

Last night I attended the second talk, “Life After Bryn Mawr:  Can You Pay My Bill?” with a handful of other seniors. Alums from different class years and staff from supporting departments and programs on campus were on hand to provide insight into postgraduate life, with this talk thinking specifically about finances and budgeting. Our first activity was to fill out a sample budget sheet with blank spaces for things like rent, cell phone, entertainment, charity, and insurance just to name a few necessities and luxuries that made the list. Looking at all of the rows and columns needing an estimate, it was pretty easy to get overwhelmed with all of the expenses associated with living outside of Bryn Mawr’s castle-like walls. The alums and staff however were there to calm our worries and give insight into how to make it all more manageable.

Can You Pay My Bill?” with a handful of other seniors. Alums from different class years and staff from supporting departments and programs on campus were on hand to provide insight into postgraduate life, with this talk thinking specifically about finances and budgeting. Our first activity was to fill out a sample budget sheet with blank spaces for things like rent, cell phone, entertainment, charity, and insurance just to name a few necessities and luxuries that made the list. Looking at all of the rows and columns needing an estimate, it was pretty easy to get overwhelmed with all of the expenses associated with living outside of Bryn Mawr’s castle-like walls. The alums and staff however were there to calm our worries and give insight into how to make it all more manageable.

We spent the rest of the time listening to the panel members talk about their experiences after college with money, finances, and budgeting, and we had an opportunity to ask questions. Throughout the discussion, words and terms swirled around us, some of which we weren’t familiar with. Everybody present was more than willing to explain and share their personal experiences with us which was very comforting and made the idea of finances post-college less intimidating. And, in true Bryn Mawr fashion, we were able to fill our tummies as we filled our minds with this truly invaluable information.

The two main ideas I came away from the discussion with were:

Figure out what is important to you. The alums made it clear that when coming up with our budgets, we should base it on what is important to us, and not necessarily on what is expected. What is important to one person may not be as important to somebody else, and that’s okay.

Being “independent” does not mean being alone. Just because we move into the real world does not mean that we can no longer ask for help, guidance, or support.

I’ve noticed during my time here that so much of what we talk about is getting through Bryn Mawr, but there isn’t as much conversation about what happens after we leave. I am so grateful for this series of talks about life after college and look forward to future events. It’s one thing to google these things, or read about them in books/online, but hearing from alumnae/i who have experienced what life is like at Bryn Mawr and then navigated the “real world”, makes hearing and understanding the information that much easier and more familiar. Thank you to everybody involved in this series! I am already feeling more confident knowing how much support there is for us, not only while we are on campus, but when we leave as well.